On June 26, 2022, HUD published a new Final Rule on Streamlining Management and Occupancy Reviews (MORs) for Section 8 Housing Assistance Programs. This is the long-awaited rule that allows for risk-based scheduling of Management and Occupancy Reviews. Having reviewed this Rule and subsequently requested clarification from HUD on some elements, this is what we know. This information will help you decipher if and how this rule impacts your portfolio of properties subsequent MOR scheduling.

-

Properties Impacted by this Final Rule:

This Final Rule applies only to the following project-based Section 8 programs administered by the Office of Multifamily Housing Programs:

• Section 8 Housing Assistance Payments (HAP) Programs for New Construction,

• Substantial Rehabilitation,

• State Housing Agencies,

• New Construction financed under Section 515 of the Housing Act of 1949,

• Loan Management Set-Aside Program,

• HAP Program for the Disposition of HUD-Owned Projects (PDSA), and

• Section 202/8 Program

NOTE: This will not include those contracts that renewed under HUD’s Mark-to-Market program which are required by law to have annual MORs.

HUD has clarified that this Rule does apply to Project-Based Rental Assistance (PBRA) Rental Assistance Demonstration (RAD) conversions as these projects are governed under regulations at 24 CFR Part 880.

It also does not apply to Senior Preservation Rental Assistance Contract (SPRAC) properties. SPRAC properties will have MORs conducted in accordance with the SPRAC Final Notice and guidance outlined in HUD Handbook 4350.1, Chapter 6.

-

Scheduling of Future MORs

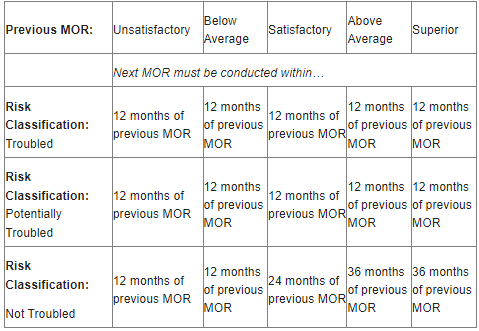

This Final Rule will become effective with the first MOR performed on or after September 26, 2022. Once this MOR has been completed, the scheduling of your next MOR will be determined by the new model. The following three (3) factors will dictate the schedule:

- HUD’s Risk Classification (Troubled, Potentially Troubled, Not Troubled)- if your property is classified as Troubled or Potentially Troubled, the next MOR will be scheduled within 12 months of the previous MOR. HUD further clarified that to confirm a contract’s current risk classification, owners must reach out directly to the assigned HUD Account Executive, not the CA. You can find your AE from the links below based on your region.

West: https://www.hud.gov/states/shared/working/west/mf/ownmgmt/ae

Northeast: https://www.hud.gov/states/shared/working/northeast/mf

Southeast: https://www.hud.gov/states/shared/working/r4/multifamily

Southwest: https://www.hud.gov/states/shared/working/southwest/mf/ae

Midwest: https://www.hud.gov/states/shared/working/r5/multifamily

- The most recent MOR Score (Unsatisfactory, Below Average, Satisfactory, Above Average, Superior)- Properties with an overall Unsatisfactory or Below Average rating will be scheduled within 12 months of the previous MOR. Those with Satisfactory rating will be scheduled within 24 months of the previous MOR. Finally, those with Above Average or Superior overall rating will be scheduled within 36 months of the previous MOR.

- Whether the property has undergone an ownership or management agent change- Regardless of the Risk Classification or previous MOR score, a property must undergo a MOR inspection within six (6) months of an approved ownership/management agent change.

-

Clarifications on Tenant File Reviews

Under the new Rule, some owners may now go as long as 36 months between MORs. HUD has clarified that once an MOR is scheduled and specific tenant files have been selected for audit, the reviewer is tasked with assessing certification actions taken since the previous MOR. This will help ensure these assessments are based on current practices in place since the last assessment.

Despite the form’s expired status since 2018, all MOR Reviewers will continue to utilize the current HUD Form 9834 for these reviews. HUD is in the process of revising this form, however, a release date has not been published for these changes.

-

Score Guidance

This Final Rule does not change the guidelines for how MOR reviewers are to score the individual subcategory ratings and calculate the overall rating for a property. MOR reviewers are tasked with following guidance outlined in Chapter 6 of HUD Handbook 4350.1 and Housing Notice 2011-11 when making these determinations.

HUD did, however, clarify that if an MOR Finding is reversed, the reviewer should determine whether the reversal would constitute an adjustment to the particular subcategory’s performance value indicator and in turn, the overall MOR rating based on modified scoring calculations.

We will keep you up to date as we are advised of more information. If you have any questions, please feel free to email us and we will do our best to get you answers.

Are you looking for help preparing for an upcoming MOR? Join us on July 27th for The Mechanics of a HUD Management and Occupancy Review and August 27th for Stress Free MORS – Maximizing Optimal Results. These live webinars will give you a summary of how this process goes, how it has changed and help you develop your “To Do” list to avoid findings.